Your credit report is one of the most critical documents for your overall financial health. It’s designed to give you (and others) a brief snapshot of your creditworthiness and credit history. But if you’ve ever looked at your credit report and had no idea what anything meant, you’re not alone.

When you go to your card issuer for a new credit card account or an installment loan, the loan amount and types of credit you qualify for will depend on the health of your credit.

Many people find their credit reports confusing and challenging, which can prevent them from understanding and improving their personal finances, raising their credit limits, or opening a new type of account.

We’re here to help. Here is a section-by-section guide on reading a credit report, along with other important information for you to know.

What is a credit report?

A credit report is a detailed record of your financial history. It captures past and current activity related to using credit accounts and services, such as mortgages, personal loans, and credit cards.

Your credit report includes an overview of borrowing behaviors, including how much you owe your creditors. It also gives lenders insights into your creditworthiness (or how likely you are to repay loans), making it an invaluable tool for them when considering loan applications.

Credit reports can be highly beneficial as they help track FICO scores, allowing you to monitor your credit rating easily over time. As such, staying informed about what appears on a credit report is integral to maintaining financial health and achieving long-term success.

Who issues credit reports?

Credit reports are issued by three major credit bureaus — Equifax, Experian, and TransUnion. They compile information about loans or debt you may have outstanding, such as mortgage payments, student loan payments, and additional lines of credit.

These credit bureaus, also called credit reporting agencies, are not government organizations, but private businesses that compile and sell your information to lenders, governments, and landlords who need information on your financial history.

Each of these organizations has its own report, but they contain the same information and often format them similarly.

How to read your credit report: a section-by-section guide

Now that we’ve covered the basics of a credit report and the credit bureaus that collect, compile, and report your information, we’re ready to look at the actual report.

Below, you will find a section-by-section walkthrough of the different sections of your credit report and what to be aware of in each area.

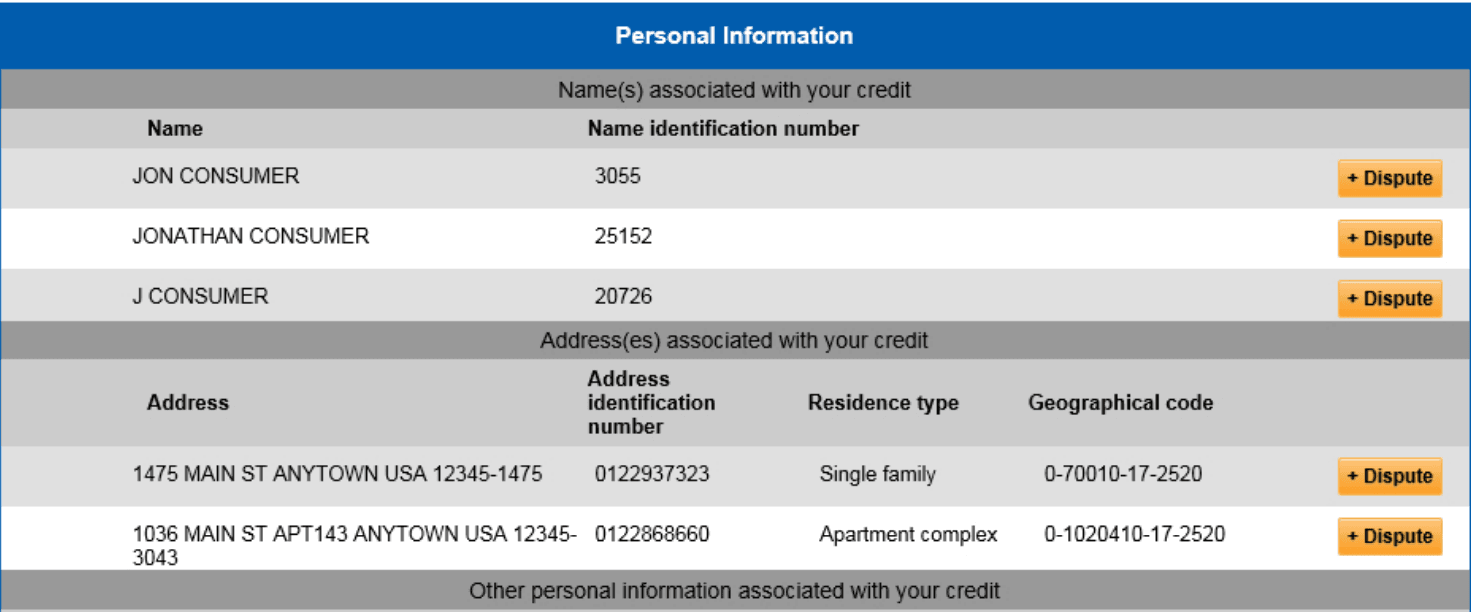

Section one: personal information

Experian

Experian

The first section of any credit report will be your personal information, which is a public record. This includes your name, address, previous addresses, date of birth, phone number, employment information, social security number, and other identifying information.

This information is updated when you apply for additional lines of credit or call the credit bureau directly to update your information.

When reading through this section, you should double-check it for errors or issues, like incorrect addresses or contact information, as issues like this can cause trouble. For instance, an incorrect address shouldn’t affect your credit score, but it may make it difficult for you to verify your identity.

Additionally, incorrect information can be an indication of identity theft, so it’s important to take action if you see inaccuracies.

Your personal information appears on every credit report, but does not change your score. Your age, name, and employment information do not factor into your credit across any major credit bureaus.

Section two: public records

The next section of your report contains information about any public records you have, such as bankruptcies, foreclosures, and civil judgments.

Bankruptcy is a powerful tool to help individuals or businesses recover from intense financial hardship. It can allow them to reorganize their debts into manageable payments and gain necessary relief from creditors.

When bankruptcy is appropriately leveraged, it can allow debtors to start over with a new outlook on their financial future.

While bankruptcy proceedings can help you erase debts and get a new start financially, personal bankruptcy will appear on your credit report for some time after the event. There are different types of bankruptcy, and they each impact your report a little differently.

Chapter Seven bankruptcy stays on your report for 10 years, while Chapter Thirteen bankruptcy only remains for seven years. However, either will have a severe negative effect on your credit score.

Section three: account information

Section three is where you finally reach the bulk of your financial history.

This section includes all the details about your credit profile, which can include information like your loan or credit card type, monthly payment history, and past due amounts. It will also contain information about the age of the account.

On a TransUnion credit report, the account information will be broken down into three smaller sections: accounts with adverse information, accounts with satisfactory information, and accounts in collections.

Accounts with adverse information

The accounts with adverse information are listed first, as they are negative items. When you fail to make the minimum required payment on time, your account will be moved to the section with adverse information.

Missing a payment every once in a while can happen to anyone, but unfortunately, even one late payment can adversely affect your credit score.

Look carefully at your adverse accounts to ensure the information presented in them is correct. Sometimes credit bureaus may have incorrect or fraudulent information. If you notice something is wrong, you can contact the credit bureau immediately to get it fixed.

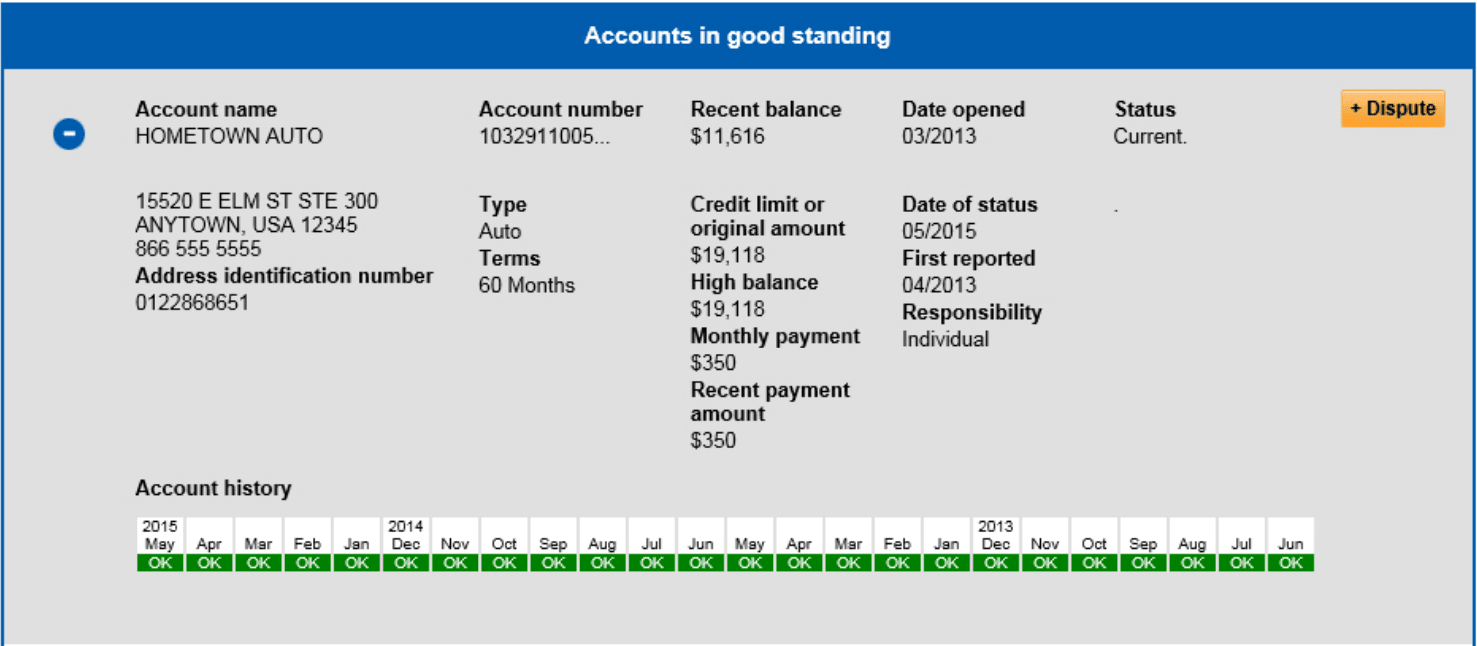

Satisfactory accounts

Next, you’ll find all the account information for your accounts that are in good standing. This section contain will contain the account information, the name on the account, and the account history.

Accounts in collections

Lastly, any accounts you have that have gone to collections are listed in this section. When an account goes unpaid for an extended period, the debt may be moved to a collections agency, where a third-party debt collector attempts to collect the debt owed.

These accounts are your biggest concern and should be given priority attention. Medical debt is treated slightly differently than other forms of debt in collections, so if you are dealing with unpaid medical bills, call a credit bureau to see how these may or may not affect your credit.

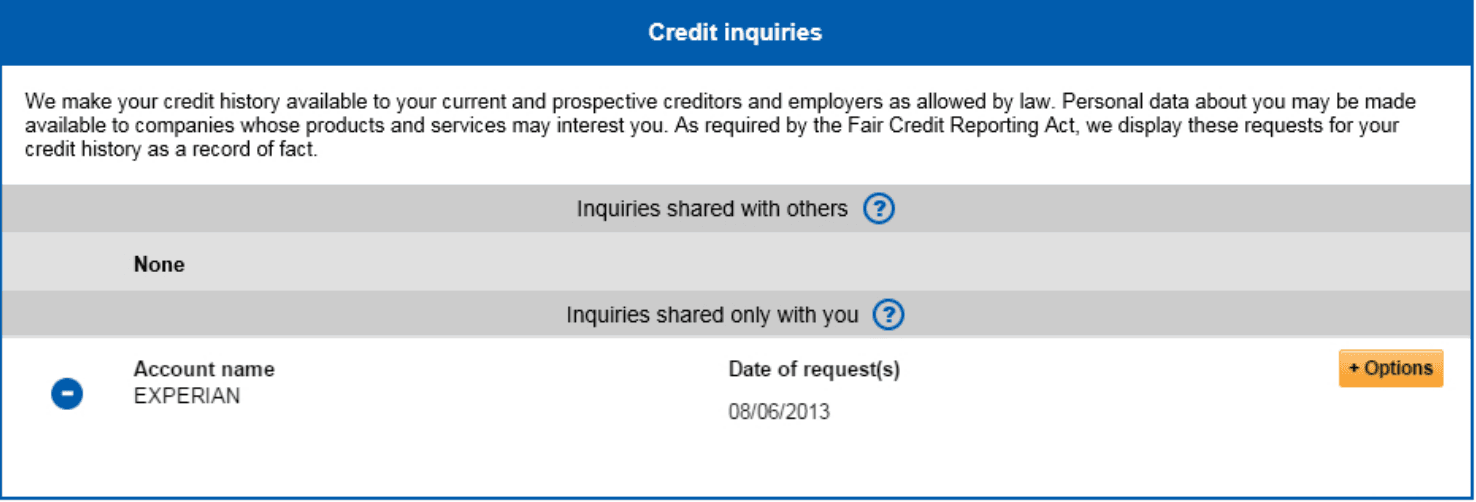

Section four: credit inquiries

Experian

Experian

Next will be any credit inquiries that you have. A credit inquiry, or hard inquiry, occurs whenever a lender seeks your report to make a financial decision about you and your creditworthiness.

Third parties can only view your credit report with a “permissible purpose,” so when an organization accesses your score, it is listed as part of your report. Hard pulls can stay on your credit report for up to two years.

Alternatively, third parties can make soft inquiries to see if you have good credit and ensure you don’t have negative information. Soft inquiries are not factored into your credit information.

Credit inquiries have a relatively limited impact on your score. Still, if you receive too many inquiries in a short amount of time, it may indicate to lenders that you are financially unstable and seeking as much credit as possible.

Section five: consumer statement and summary of rights

Experian

Experian

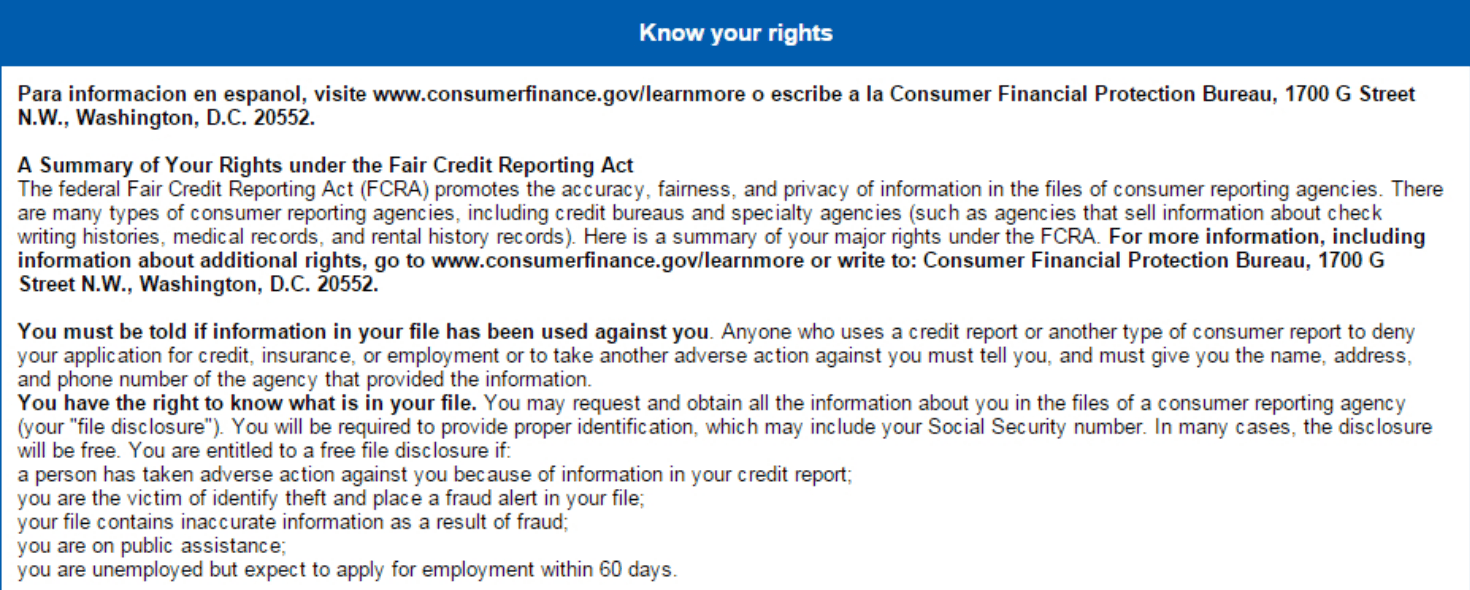

The final portion of your credit report consists of the optional consumer statement and the summary of your rights.

While a consumer statement is not required for anyone on their report, it can be helpful if you have an explanation for a concerning section of your credit report. The statement can be no longer than 100 words.

Save this for extreme circumstances, such as sudden job loss, illness, or emergency.

Finally, there is the summary of your rights, which gives you the legal breakdown of your rights under the Fair Credit Reporting Act.

This includes information about how often you are allowed free access to your score, who may access your report and for what reasons, and other information about your credit rights. If you’ve never read through the section, it may be interesting.

And that’s it. While your credit report may be long, you can use it to gain insights into your financial health.

Reading a credit report: final thoughts

Your credit report is the most important document to keep track of your finances, and now you understand how to decipher it. Section by section, your credit report helps to paint a picture of your creditworthiness, potentially helping you get better interest rates, more credit, and credit cards with better benefits.

If you want to improve your financial knowledge, consider Vital Card. Vital is the credit card that pays you to share and spend responsibly. With Vital, you can support your credit score with good spending habits to increase your monthly cash-back rewards.

Be sure to check your credit report frequently for updates and changes. You can get a free copy of your credit report at annualcreditreport.com.

Sources

What is a credit report? | Consumer Financial Protection Bureau

Credit Report: What’s on Your Credit History Report | Debt.org

Reading Your Annual Credit Report: Public Records and Inquiries | Credit.org

How Long Does Bankruptcy Stay on Your Credit Report? | TransUnion

Can One 30-Day Late Payment Hurt Your Credit? | Experian

Experian Sample Credit Report | Experian

Vital Card blog posts are intended for informational purposes only and should not be considered financial or any other type of advice.